Governance

Governance | Risk Management | Ethics and Compliance | Executive Compensation | Tax Policy

Global Tax Policy

In compliance with the Renesas Code of Conduct, Renesas and its Group companies ensure transparency and comply with tax laws and regulations of the countries we operate in. Renesas’ tax policy has been approved and is owned by Renesas’ Board of Directors and serves as the guiding principles to ensuring the long-term sustainability of our business.

The Audit Committee oversees the audits regarding compliance with tax policies as part of legal compliance auditing. In addition, the Audit Committee conducts financial statement audits, including the verification of tax-related matters based on the interview with CFO and in collaboration with the company’s accounting auditor (external audit firm). The committee then reports the results to the Board of Directors and during our Annual General Meeting of Shareholders. CFO quarterly reports important financial topics including tax matters to the Board.

1. Transparency

We aim to be transparent with our tax requirements by keeping our internal team, shareholders, and other relevant individuals aware of the Company’s tax positions, risks and strategies. We also ensure that all decisions are made with an appropriate level of analysis and are supported with evidences of facts and circumstances involved.

2. Compliance with Tax Law

We aim to remain compliant with the law in each country we operate in. We will stay up to date with any changes in tax law and seek confirmation when policies are unclear. In addition, we conduct internal training for employees in order to maintain the high quality of tax awareness.

3. Tax Efficiency

In order to maximize shareholder return, we continue to make our best effort to be efficient with our tax liabilities by applying for tax benefits and tax incentives within the scope of business objectives and legislative intents. A valid business purpose and substance is of the utmost importance to us. As such, we do not enter into transactions solely for the purpose of reducing tax burdens and we do not conduct schemes for the purpose of tax avoidance or profit shifting by using offshore secrecy jurisdictions or so-called “tax havens”.

4. Avoidance of Double Taxation

In order to avoid double taxation on identical economic profits, we actively seek applicable tax treaty relief and mutual agreement procedures among the countries where we conduct business.

5. Transfer Pricing

With regard to internal transactions within Renesas and its global subsidiaries, we aim to allocate the appropriate profit based on the arm’s length principal in accordance with the OECD transfer pricing guidelines. In addition, we utilize Advance Pricing Agreement (APA) with the tax authorities in order to minimize tax exposures related to transfer pricing.

6. Uncertain Tax Positions

We aim to take the law not just as written, but as it was intended to be understood and applied. This means staying up to date with both official and unofficial explanations of tax laws. We commit to doing our due diligence and having support for the positions we take and disclosing when a position is uncertain.

7. Relationship with Tax Authorities

We aim to maintain a relationship of trust with tax authorities by providing appropriate information and responding sincerely to tax authorities. If a difference of opinion should arise with each country’s tax authority, we will communicate constructively with the tax authority to seek a resolution to the issue.

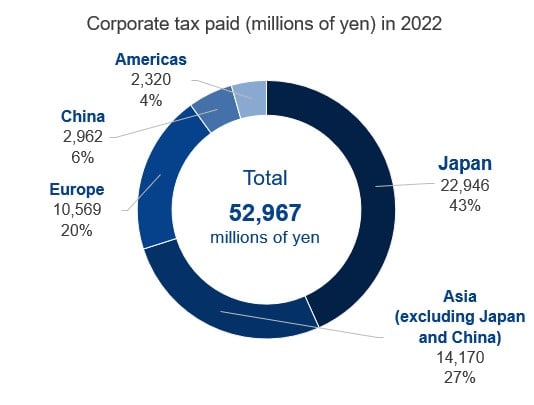

Corporate Tax Paid by Region

*The above chart shows the amount of corporate tax paid by Renesas Group and the percentage of payment in each geographic region for the fiscal year ended December 2022.